Although still expensive to develop and produce, large molecules are rapidly taking over.

by Susan Thompson, Technical Director at VxP Biologics

For most of the previous century, much of pharmaceutical research focused on the development of small-molecule “blockbuster” drugs, which treated a wide variety of diseases for a great number of patients, and could thus be patented and turned to tremendous profit. Over the past few years, though, the days of the small molecule have been quietly drawing to a close.

As effective cures become more difficult to find (particularly for diseases like cancer and immunological disorders) a growing number of pharma firms are turning to biological research, adapting molecules and processes found in living organisms to therapeutic uses. This requires the use of biologics: large, complex molecules manufactured inside living cells.

Despite some promising success stories, biologics remain highly expensive to develop and manufacture. They’re also almost prohibitively expensive on the patient’s end of the bargain, frequently costing $45,000 or more for a single round of treatment. Even so, new regulatory approvals, continue to draw increasing investment to the biologic sector.

Biologics provide highly targeted solutions to specific health problems.

A new selection of biologics are coming on the market right now.

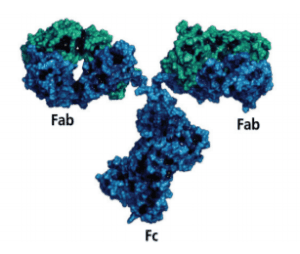

Although biologics appear to be a twenty-first century phenomenon, their earliest successes date back more than 30 years. In 1986, biologics known as monoclonal antibodies (mAbs) first appeared on the market, effectively treating certain types of cancer that responded poorly to conventional therapies. Since then, mAbs have become common treatments for rheumatoid arthritis, prosiasis, and other autoimmune disorders.

Unlike traditional small-molecule drugs, biologics such as mAbs are created using proteins from human or animal cells, often grown inside bacteria, or inside cloned cells from a rodent’s spleen. These proteins are engineered to perform a very specific molecular task, such as counteracting a particular immune response, or altering the rate at which certain cells destroy themselves. They accomplish this by fitting into specific molecular receptors, like a key into a lock.

Such specificity has made biologics highly effective in the treatment of disorders like Crohn’s disease and multiple sclerosis, which respond poorly to conventional therapies. The specificity of biologic therapies also means they rarely produce unexpected side effects; a benefit that makes them highly desirable for patients already suffering from symptoms like dizziness or nausea.

At the same time, however, the very complexity of biologics makes them difficult and expensive to research, develop and produce.

A new selection of biologics are coming on the market right now.

Another opportunity comes in the form of biosimilars.

Over the past three years, the U.S. Food and Drug Administration (FDA) has approved a growing list of biologics; and even more are expected to gain approval over the coming months. One of the early successes was Humira, a rheumatoid arthritis therapy that received FDA approval in 2002, and has gone on to generate sales of more than $11 billion.

By 2013, biologics already accounted for at least 22 percent of sales for pharma firms; and the investment firm Morningstar has predicted a rise to 32 percent within the next six years. More than 900 biologics are currently under development in the U.S. alone. Many of these are part of the new generation of gene therapy drugs, which replace problematic genes in a patient’s cells with improved versions. These drugs are already available in China and Germany, and are likely to become common in the U.S. within the next few years.

Even so, biologic development is prone to significant hurdles. In 2014, Swiss pharma giant Roche suffered significant losses to its share price, when it revealed that two of its anti-cancer biologics, Kadcyla and Perjeta, weren’t performing up to expectations. These results, combined with the fact that Kadcyla cost a staggering $140,000 per course, caused Britain’s National Institute for Health and Clinical Excellence to actively recommend against the treatment.

Indeed, affordability is a major concern for many biologics. Toward the lower end of the cost spectrum, biologics for rheumatoid arthritis cost more than $12,000 per year; and patients have to continue taking them over the long term. Costs like these are prohibitive for many patients even in first-world countries, and are simply out of the question for most of the developing world.

What’s more, the increasing proliferation of biologics have brought them under stricter regulatory oversight. In 2014, the governments of Italy and France recognized that anti-cancer biologic Avastin also served as an effective therapy for macular degeneration; and that it cost far less than Lucentis, the biologic marketed specifically for that disorder. The two countries approved Avastin for as a therapy for macular degeneration, saving their health services an estimated $273 million, while cutting deep into pharma companies’ profits.

Another opportunity comes in the form of biosimilars.

For pharma developers seeking to create a new biologic, cost and complexity are only a few of the many hurdles. Because the active pharmaceutical ingredients (APIs) in these drugs are produced exclusively within living cells, the only way to develop a “generic” version of the same API would be to replicate the entire intracellular process; and that process as a whole is typically protected under a patent.

One possible solution would be to develop a biosimilar: a protein close enough in shape to accomplish the same molecular results, produced via a different biological process. However, although proofs of concept for biosimilars do exist, U.S. law included no provision for them until 2010, when the Public Health Service Act was amended to allow for them. In 2016, the very first biosimilar appeared on the market. It’s a leukemia treatment called Zarxio, and costs about $1,000 less than the biologic it replaces.

Following the success of Zarxio, the Canadian firm Apotex won FDA consideration for its biosimilar of Neulasta, an anti-cancer biologic produced by the American firm Amgen. There’s every indication that biologic developers plan to bring more affordable biosimilars to market over the next several years.

In fact, researchers at the Rand Corporation have predicted that health care payers may save a total of $44 billion over the next 10 years, thanks to biosimilars; while Express Scripts predicts a savings on the order of $250 billion. However, many biosimilars are still likely to remain expensive for patients, until the technology improves enough to significantly drive down manufacturing costs.